It’s a well-worn phrase that I’m sure you’ve heard before.

The grandparents start the business, it becomes successful, the next generation build it further and the grandchildren subsequently ruin it and squander the wealth.

Of course it doesn’t happen this way every time. When we look at our typical client profile we see a great similarity – Families running businesses trying to build better lives for the future generations. And leave a lasting legacy.

We have developed what I guess market-teers would call a strap-line for our business that explains what we do – “We look after families, their businesses and their wealth across the generations”

By identifying this particular niche we can see that there are common financial planning requirements that come up frequently. That’s not to say that each situation is not unique but there are similarities in what each family is trying to achieve financially.

We find that we are often referred up and down the family generations and it really helps when there is family understanding and consensus when building the financial plan. Using our cash flow modelling process also provides a long term view of how wealth and indeed the value built up in the business can help families for a great number of years.

We can establish when it might be right to exit a business and extract wealth tax efficiently for the current generation while leaving a viable firm for the next generation.

We strongly believe that as family wealth financial planners we need to take a much longer view of our clients and consider 40 years, 50 years and even longer relationships.

Taking a cross-generational view also helps with our passively engineered investment approach by allowing capital markets to reward you for investing over the much longer term. You can let the beauty of compound returns achieve the family financial goals without exposing yourself to unnecessary risk.

In other words, if 5% pa or 6% pa return over the next 30 years gets you there, then don’t aim for 10% pa and find you are exposed to greater volatility and portfolio value swings than you’d like to be.

Being smart across generations with robust tax-planning can also provide greater wealth for the family and taxes such Inheritance Tax, can be mitigated or avoided altogether by taking the long term view.

Protecting the family and the business by using third-parties to shoulder the risk if something happening to the driving family member is vitally important and again something that should be known and understood by the family group. There is little point in creating wealth only to have is lost on the death or serious illness of one individual family member.

From a cost point of view, there are other benefits to this approach. There are often family discounts to be had by pooling assets on an investment platform – we do this through our Personal Investment Account and it can lead to substantially reduced costs that apply to all members of the family group over a long period of time.

I hear that slow-cooking is now become the natural antidote to fast-food and perhaps it’s time to apply this approach to your financial planning – easy does it, take long term considered views and we might just get beyond three generations.

Please speak to us if you have any concerns that your current financial arrangements are quite what you’d hope they’d be.

Roland Oliver

October 2013

How we can change your life this week

Much of human understanding of the world is built on models that attempt to recreate complex systems in a simpler form. This ranges from the reactions of the economy to a reduction in government expenditure to the effect of CO2 on climate change.

No model will ever be perfect as there are too many intricate relationships at play, but I am sure that most would agree that we are better to have some understanding of how these systems work than nothing at all.

Now let’s consider financial planning. It is one of those disciplines that, whether you are interested or not, it still applies to you. Every single person reading this blog will, in the simplest sense, have things they want to do, a number of years ahead of them, and an exhaustible amount of money flowing in and out.

There are different attitudes to this problem. Apathy is one. Some may not want to think about it because it will stop all of today’s fun. Some may have a vague idea it will all work out. Some people may have fashioned a rudimentary spreadsheet in Excel to try and boil the situation down into hard numbers, but once the projections involve discounted values of future contributions and the timescale stretches out, things can get complicated very quickly.

There are different attitudes to this problem. Apathy is one. Some may not want to think about it because it will stop all of today’s fun. Some may have a vague idea it will all work out. Some people may have fashioned a rudimentary spreadsheet in Excel to try and boil the situation down into hard numbers, but once the projections involve discounted values of future contributions and the timescale stretches out, things can get complicated very quickly.

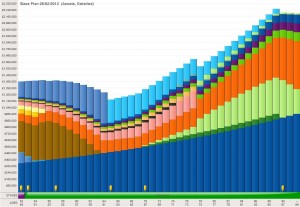

At OAM, equipped with the market leading cash flow modelling software, Voyant, we can produce charts, projections, balance sheets and inheritance tax ledgers. We can put in key events such as weddings and the sale of a business. We can even kill you off next year, just to see what happens. We can tweak every assumption that lies behind the model to make it as realistic to your circumstances, and the wider economy, as is possible.

The level of detail is quite astonishing. Every change from HMRC on future tax rates are factored into models automatically, within days of announcement.

This week we made a big difference to a couple’s life, confirming that which they suspected: they don’t actually need to work anymore. They have accumulated more than enough to last comfortably until their assumed mortality age (itself selected by the client on the grounds of family history and the Office of National Statistics).

In the past we have helped clients assess their inheritance tax liability, choose between different redundancy options, set the amount of savings contributions required to pay for their children’s education and more.

In the past we have helped clients assess their inheritance tax liability, choose between different redundancy options, set the amount of savings contributions required to pay for their children’s education and more.

As stated above, every model has its limitations, but it is worth coming to see us to gain some understanding of how your future looks rather than earning and spending money in the dark. And as we see confirmed every day when small tweaks are made to client’s plans, a change today can make life quite different in 20 years.

Malcolm Stewart

It won’t get better if you pick it

Anyone with teenage kids will be familiar with the headline above; stop picking, scratching, fiddling and generally messing about otherwise it will never heal up!

Time for a tenuous link – “What’s investing got to do with pubescence and hormones?” I hear you cry…

Well, as passive strategy investors, the idea of getting the appropriate risk-rated asset allocation right, keeping costs low and maintaining discipline is at the heart of our philosophy.

We picked up a new follower on Twitter today (for which I’m grateful) and for reasons which should become apparent, I won’t mention their name…

In essence it was (yet) another business offering guidance to my business on how to create investment strategies for clients that I think were based around “over 20 years of experience” and some very fancy software designed to spot/recognise trends/sectors that should be the best performing etc etc.

Their website makes some bold claims and some interesting references to Warren Buffet but overall I was confused as to what the point was.

All in all it seemed like another company trying to prove that by using their methodology, philosophy and gee-whiz technobabble, you can get better results from you investments.

I suggest doing less and trusting to more simple understandings will work far better.

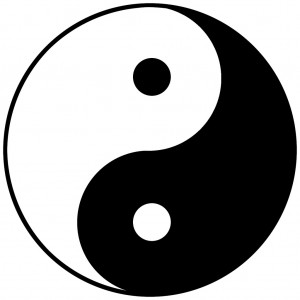

The Chinese philosophy of Taosim has a word for it: “Wuwei”. It literally means “non-doing”. In other words, the busier we are with our long-term investments and the more we tinker, the less likely we are to get good results.

The Chinese philosophy of Taosim has a word for it: “Wuwei”. It literally means “non-doing”. In other words, the busier we are with our long-term investments and the more we tinker, the less likely we are to get good results.

That doesn’t mean, by the way, that we should do nothing whatsoever. But it does mean that the culture of “busyness” and chasing returns promoted by much of the financial services industry and media can work against our interests.

Investment is one area where constant activity and a sense of control are not well correlated. Look at the person who is forever monitoring his portfolio, who fitfully watches business TV or who sits up at night looking for share tips on social media.

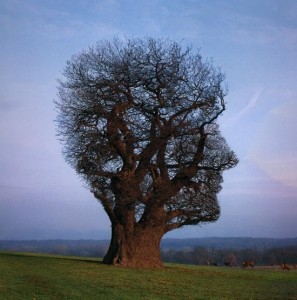

In Taoism, by contrast, the student is taught to let go of factors over which he has no control and instead go with the flow. When you plant a tree, you choose a sunny spot with good soil and water. Apart from regular pruning, you leave the tree to grow.

So we can’t control movements in the market. We can’t control news. We have no say over the headlines that threaten to distract us.

But each of us can control how much risk we take. We can diversify those risks across different assets, companies, sectors and countries. We do have a say in the fees we pay. We can influence transaction costs. And we can exercise discipline when our emotional impulses threaten to blow us off course.

I think I may have finally got my point across; to get a better investment experience, talk to us about our investment approach and don’t pick at your current one in the meantime!

Apathy or action – can you really afford to ignore your business vulnerabilities?

There is no question that business protection considerations are a hot topic right now.

There is no question that business protection considerations are a hot topic right now.

In the last few weeks there have been several discussions launched on Linkedin asking what small businesses are neglecting in terms of business protection and whether or not business owners are sticking their head in the sand when it comes to business protection.

There is a massive gap in the business protection market among UK business owners and some of the recent statistics from Legal & General in support of the Every Business Matters campaign on Unbiased.co.uk are quite staggering but not unsurprising.

There are just too many businesses out there who have insufficient or no cover in place to allow operations to continue on the death or serious illness of a shareholder, partner or key person.

I don’t think it’s fair to say business owners are sticking their head in the sand with regards to this issue, many are well aware of the seriousness of this level of risk and the financial havoc death or critical illness can bring on firm.

The issue is perhaps lack of guidance and education. Directors, Partners and Key People are busy doing what they do best on a day to day basis, growing their companies, developing their brand and making the venture a profitable as possible. Finding the time to discuss, consider and understand what their business protection needs are, is often a hard thing to do for no reason other than they are too busy doing other things.

Add to this, the general resistance amongst many advisers to sell business protection because they believe it is too complex or they don’t understand all the nuances of the cover and you have a great recipe for avoidance and apathy across the business sector.

I believe we have a responsibility to support business owners, to help them identify where their vulnerabilities lie and to explain the process to put the correct cover in place with the appropriate legal documentation.

It doesn’t have to be complicated or painful, taking the time to evaluate a business, identify key areas of risk and providing a solution is a tremendously rewarding exercise.

We have helped many businesses over the years to put the correct planning in place and time and again when the exercise is complete the owners reaffirm the process has given them a real peace of mind and sense of control. They feel able to move on with the day to day development of the business safe in the knowledge that all their hard work to create a business with value is underpinned with the correct protection.

If you have any concerns with respect to your business or you would simply like more information on business protection then we would love to hear from you.

Take action and don’t let apathy expose your business to unnecessary risk!

Dr C.

Guest Blog: The Mindful Way of Doing Business

Introduction

This week we are delighted to post an inspirational guest blog by Martin Stepek – award winning and critically acclaimed poet and writer and current CEO of the Scottish Family Business Association.

This week we are delighted to post an inspirational guest blog by Martin Stepek – award winning and critically acclaimed poet and writer and current CEO of the Scottish Family Business Association.

www.martinstepek.com

www.twitter.com/martinstepek

The Mindful Way of Doing Business

So what does a contemplative practice developed 2500 years ago by the Buddha have to do with your business? Surprisingly a lot actually, and even more importantly, in some of the key areas of your working – and personal – life.

Mindfulness is the technique of trying to catch each moment in its entirety, without the usual inner commentary or opinion we all tend to have. So it could be just reading an email calmly and carefully, without prejudging its overall contents because of a) who the sender is, or b) our opinion halfway through the message. Or it might be becoming aware of tiredness or irritation inside our mind during an important meeting (and let’s face it if it’s not an important meeting why are you having one?)

Mindfulness is the technique of trying to catch each moment in its entirety, without the usual inner commentary or opinion we all tend to have. So it could be just reading an email calmly and carefully, without prejudging its overall contents because of a) who the sender is, or b) our opinion halfway through the message. Or it might be becoming aware of tiredness or irritation inside our mind during an important meeting (and let’s face it if it’s not an important meeting why are you having one?)

Mindfulness also refers to the more formal practice of sitting, eyes closed but alert, and focusing clearly but lightly on the breath or on a particular thought or emotion.

We can practice mindfulness literally anywhere or while doing any activity. It’s the ultimate portable gadget. I do it while waiting for a train, while doing the ironing or the washing up, even when I first wake up before I’m out of bed.

But why should you be doing it? And believe me you should!

Mindfulness helps us in two ways; one the prevention of negative stuff, the other the cultivation of positive stuff. I use stuff deliberately as there’s a whole range of things that mindfulness concerns and affects.

Let’s look at the negatives. I don’t know anyone in business who isn’t sometimes affected by stress, 24/7 work, tiredness, frustration, niggles, irritation or anger, down to the really serious stuff of chronic anxiety, clinical depression or a sense that the work you do is shallow, unfulfilling, meaningless… and that somehow you’re missing out on the important things in life. Mindfulness deals with all this… yes it’s “stuff” isn’t it? I’ll show evidence in a moment but let’s look at the positives now.

Mindfulness develops our sense of calm focus, clarity of thinking, creativity and compassion. It enables us to remain clear-minded under pressure, make decisions more wisely, and get home at the end of the day still capable of having a true relationship. How practical is this in running a business, in living a full life? I’d argue that apart from cash flow this good “stuff” is the most important set of features a business must have to succeed.

And the evidence? There are now over 2500 scientific journal articles on these effects, from the world’s leading universities; Oxford (has a mindfulness centre), Harvard, Yale, UCLA. Glasgow University has done ground-breaking research on mindfulness, and Aberdeen University offers an MSc. The internet is awash with papers, books, podcasts, interviews and lectures. Check them out.

I’ve been practicing since 1998, teaching it since 2004, to businesses, charities, social enterprises, schools, even Shotts Prison. I teach a free drop-in class on Tuesday evenings at 6.30-7.30pm at the University of West of Scotland in my home town of Hamilton. Mindfulness has helped me lead a national business support organisation, publish an award-winning reflection on my father as a Soviet labour camp victim, and much more beside, while still hopefully being a happy, contented and loving father, husband and friend.

As I said, you really should try it!

Changing the Weather

That’s it.

I’ve had about as much as I can stand of the Scottish Spring weather. Grey, overcast, wet, windy, freezing, sunny, & generally miserable.

With damp patches.

No amount of positive mental attitude will change the weather but a wee bit of planning might change where the weather I’m exposed to comes from…

It’s been very noticeable of late that the new enquires we have been getting are less concerned with the true nitty-gritty of what my pension/ISA/savings actually are but much more around the use of lifetime cash flow modelling to show me what’s going to happen.

The term peace of mind is often used in conversations with new clients and it’s very interesting that successful, well paid business men & women drive on without a real understanding of what their numbers actually might mean for them.

In other words, they have no peace of mind but rather a nagging doubt that it might not just be enough.

Using a complex powerful cash flow modelling tool like Voyant provides the framework to allow a little dreaming to take place and it’s a tremendous feeling to see people starting believe they might just be there financially or with a bit of further guidance they can get the life they want.

Our job is then to become custodian of the wealth, provide sensible investment strategies and use the tax advantages of various “wrappers” to keep the clients in the style to which they’d like to become accustomed!

Our job is then to become custodian of the wealth, provide sensible investment strategies and use the tax advantages of various “wrappers” to keep the clients in the style to which they’d like to become accustomed!

Malcolm Stewart will be expanding on the details on how, what and why lifetime cash flow modelling is so powerful in his next blog.

In the meantime, as I write the temperature in Sacramento, California is a sunny 33c.

Call me to arrange your retirement in a country and climate of your choosing.

Roland Oliver

The (Transfer) Value of the Key Man

As the tributes rightly fly in for Sir Alex Ferguson, the most successful manager of our time, consider his value to the business over the last 26 years.

As the tributes rightly fly in for Sir Alex Ferguson, the most successful manager of our time, consider his value to the business over the last 26 years.

Hindsight is wonderful and exact and few would have been able to put a monetary value on Sir Alex especially at the inauspicious start to his Man U career.

In an age when football players are valued in 10s of millions, its intriguing to think of what transfer value might have been placed on Ferguson at the beginning of his last season?

A single player might surely make a difference, but if RVP never played again for Manchester United, chances are the new manager will replace him with somebody as good, better?

Imagine the effect on the share price (and longer term value) of Man U Plc if Sir Alex had carked it anytime during the last 26 years?

I’m sure, as a sensible employer, Manchester United would have had him extremely well insured from a Keyman point of view…or maybe they didn’t.

Time to look at your own Sir Alex and his or her value to you business and make sure that if its not a gentle exit to retirement and more of a catastrophe that makes them suddenly not there any more, you’re financial well prepared for the consequences.

Please speak to us about our Transfer Value Keyman cover solutions before the next 26 years pass.

Roland Oliver

The Great Golf Ball Debacle

I would bet my life that most people reading this have experienced poor customer service of late.

I find myself in the all too common position recently of being on the receiving end of some spectacularly bad customer service from a well known magazine subscription provider.

They have happily taken my annual subscription for four years now so when the renewal came round this January I thought I would stick my neck out and ask if they would throw in the snazzy and expensive golf club which was being offered to “new” subscribers only as a free gift.

To be honest I expected a flat out no, but when they came back with a yes of course Mrs Armstrong I was delighted. Victory for the little man (or woman in this case), you don’t ask you don’t get and all that.

18 emails, 12 weeks and a strongly worded letter later do I have said free gift? That would be a no. Ben, or Becky or was it Matt or Verity, I’ve lost track now, have all provided their sincerest apologies and they do understand why I would be very frustrated with this outcome. Do they really, seriously, are they kidding?

They have assured me they want to retain my custom so whilst they can no longer provide the free golf club now it’s out  of stock they would like to know if I would settle for 12 SRIXON AD333 golf balls. At the end of my tether I said yes, it suddenly didn’t feel like such a victory, I think I might have even gained the odd grey hair through the whole dire process.

of stock they would like to know if I would settle for 12 SRIXON AD333 golf balls. At the end of my tether I said yes, it suddenly didn’t feel like such a victory, I think I might have even gained the odd grey hair through the whole dire process.

So the golf balls have arrived, they are indeed the SRIXON AD333s, just one small problem, I may pay for the renewal but the magazine goes to my father, he plays, I don’t and yes you’ve guess it, they sent the blooming balls to me!!

I don’t feel remotely rewarded for my loyalty and most certainly will not be renewing the subscription next year. I don’t appreciate being asked to “settle” for a back up gift because someone forgot to do their job properly and process the correct free gift in the first place as promised.

Nothing grates more on a customer than promises not delivered, loyalty being taken for granted and fake sincerity from a faceless person who you know could not care less about your predicament.

It’s not hard to reward loyalty, to provide a good service, to make the consumer feel good about the decisions they have made to buy into your brand, product or service.

We continually strive to improve the customer experience at OAM – and in order to do so actively encourage feedback on our services.

Personally nothing gives me greater pleasure than developing client relationships built on confidence and trust. Over the years I’ve learned that customer loyalty is of great value and not to be taken for granted.

Recent press covered the immediate response by the high street pharmacy Boots in relation to their error of judgement in introducing gender signage for children’s toys. Their customers took to Twitter and Facebook to make heard their views on this seemingly sexist stereotyping – http://bit.ly/14PAT80.

Boots listened to their customers, heard what they had to say and took action, immediately removing the in store signage which had been considered offensive.

How refreshing that a market leader listened to what their customers had to say and their decisive action to rectify the situation will no doubt have resulted in continued customer loyalty.

Happy customers are good ambassadors and all of us in business would do well to remember this.

Dr Claire Armstrong

Spotlight on EISs – Is risky tax relief for you?

At a time when many in the city may have just received their bonus and will be paying a healthy dose of tax with it, I thought it would be a good time to mention a couple of investment vehicles that come with tax relief.

At a time when many in the city may have just received their bonus and will be paying a healthy dose of tax with it, I thought it would be a good time to mention a couple of investment vehicles that come with tax relief.

Tax relief doesn’t come for free of course, and to obtain it you must be prepared to put up with higher levels of risk.

The first of these vehicles to be discussed is Enterprise Investment Schemes (EISs).

EISs are intended to help certain types of small, higher-risk, unquoted trading companies raise capital by providing tax relief for investors. They took over from Business Expansion Schemes in 1994.

Income tax relief on EISs at present is 30% for qualifying investments and the maximum annual amount an individual can contribute at is £1million. Interestingly, income tax relief is given in the year of assessment in which the shares are issued, rather than the year of investment. So as an investor, it might be possible to carry back income tax relief to the previous tax year.

The shares must be held on to for 3 years minimum or the relief will be withdrawn.

Capital gains can also be deferred for tax reasons by investing the gain into an EIS. There are various caveats to this and I would urge you to contact us to find out more if you think this could be useful in your circumstances.

No mention of EISs should come without a big fat risk warning. Investing in unlisted trading companies is a very high risk activity and the possibility of a company failing is very real. There is also a high liquidity risk as, even after the minimum three year period, it may be difficult to dispose of the shares.

Approach with caution, but, if you are interested in how this could work for you please get in touch.

Please note that all figures given represent our understanding of current HMRC legislation and this article does not constitute financial advice.

Come back in a fortnight for a look at Venture Capital Trusts (VCTs).

Malcolm Stewart

Know your customer

Rewarding your customer for long and valued custom must make sense.

An acknowledgement that you have appreciated them sticking with you and by way of thanks, a gift or reward that is appropriate and makes the customer feel good about dealing with your business would be a good thing to do.

I will, however, briefly tell a short story to demonstrate that while the principle might be strong, if the delivery is wrong it will seem like big business going through the motions.

My client, a vibrant, cheerful and energetic 84 year old widow told me today that her 59 years  membership with a certain motoring organisation had been rewarded recently by the offer of a Gold Membership.

membership with a certain motoring organisation had been rewarded recently by the offer of a Gold Membership.

She was naturally delighted and was soon checking through the many new benefits she was entitled to as a result of her loyalty…

She could now drive abroad and it would be covered. She could nominate a 17 year old relative to drive her car. And so on.

And the good news was that her renewal premium this year would only be £198.

It was £178 last year but look at all the benefits you can enjoy.

She may be 84 but daft she isn’t and could spot the flaws in her prestigious Gold Membership reward.

In fairness, one short, sharp phone call later, she was still a Gold Member but for £100 – I still think after all this time they could have called time on the fee – but a gesture never the less I suppose.

Rewarding clients is the right and proper thing to do, but best to check its something relevant and will be appreciated by them.

Roland Oliver