Yesterday was very eventful, with the early morning news that the BOE reduced the base rate to 0.25%, accompanied by market volatility and afternoon budget announcements.

Overnight, the news from Trump to stop travel from the Schengen European countries to, and from America helped lead to further volatility and the FTSE, opening another 5% down, and at the time of writing is down 9%.

Given these exceptional circumstances, we thought at this time it would be prudent to communicate our thoughts.

Our belief is that long term investing is designed to tolerate short term volatility both up and down, and this is backed up by long term equity returns data. Making knee jerk reactions at times like these often leads to a poorer investment experience.

Nevertheless, with the current news being dominated by headlines about the coronavirus and stock market falls, we fully understand any nervousness about the impact in the short-term on your investment portfolios.

It’s worth considering in the first instance as to when you might need your money; do you need it all right now or does it need to last you say, for the next thirty years?

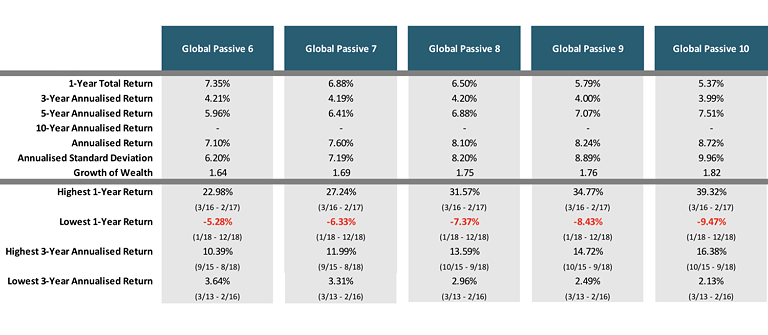

It might also worthwhile to consider actual performance of a balanced portfolio over a range of periods to demonstrate how the effects of one year’s performance are diminished.

We have published data on the performance of all our portfolios on our website and we ask you to consider the best and worst numbers over the longer periods and you will see despite some short term volatility, the longer term averaged returns have tolerated those short term losses.

Performance

Performance Summary Statistics: 01/06/2009 – 31/01/2020

Date as of January 31st 2020.

Performance data shown represents past performance and is not a guarantee of future results. Current performance may be higher or lower than the performance shown.

The attached article from Dimensional was written 2 weeks ago as the markets were in the early stages of reacting to the coronavirus reaching the wider world. Whilst things have moved on in terms of volatility, the message still remains strong and relevant.

https://eu.dimensional.com/en/perspectives/the-coronavirus-and-market-declines

If you have any questions or would like to chat through your thoughts or concerns please do not hesitate to get in contact with us.

Roland, Jonathan and Nikki.

In this blog I want to give you a quick overview of our investment beliefs at Oliver Asset Management, namely Evidence Based Investing.

In this blog I want to give you a quick overview of our investment beliefs at Oliver Asset Management, namely Evidence Based Investing.