It’s a well-worn phrase that I’m sure you’ve heard before.

The grandparents start the business, it becomes successful, the next generation build it further and the grandchildren subsequently ruin it and squander the wealth.

Of course it doesn’t happen this way every time. When we look at our typical client profile we see a great similarity – Families running businesses trying to build better lives for the future generations. And leave a lasting legacy.

We have developed what I guess market-teers would call a strap-line for our business that explains what we do – “We look after families, their businesses and their wealth across the generations”

By identifying this particular niche we can see that there are common financial planning requirements that come up frequently. That’s not to say that each situation is not unique but there are similarities in what each family is trying to achieve financially.

We find that we are often referred up and down the family generations and it really helps when there is family understanding and consensus when building the financial plan. Using our cash flow modelling process also provides a long term view of how wealth and indeed the value built up in the business can help families for a great number of years.

We can establish when it might be right to exit a business and extract wealth tax efficiently for the current generation while leaving a viable firm for the next generation.

We strongly believe that as family wealth financial planners we need to take a much longer view of our clients and consider 40 years, 50 years and even longer relationships.

Taking a cross-generational view also helps with our passively engineered investment approach by allowing capital markets to reward you for investing over the much longer term. You can let the beauty of compound returns achieve the family financial goals without exposing yourself to unnecessary risk.

In other words, if 5% pa or 6% pa return over the next 30 years gets you there, then don’t aim for 10% pa and find you are exposed to greater volatility and portfolio value swings than you’d like to be.

Being smart across generations with robust tax-planning can also provide greater wealth for the family and taxes such Inheritance Tax, can be mitigated or avoided altogether by taking the long term view.

Protecting the family and the business by using third-parties to shoulder the risk if something happening to the driving family member is vitally important and again something that should be known and understood by the family group. There is little point in creating wealth only to have is lost on the death or serious illness of one individual family member.

From a cost point of view, there are other benefits to this approach. There are often family discounts to be had by pooling assets on an investment platform – we do this through our Personal Investment Account and it can lead to substantially reduced costs that apply to all members of the family group over a long period of time.

I hear that slow-cooking is now become the natural antidote to fast-food and perhaps it’s time to apply this approach to your financial planning – easy does it, take long term considered views and we might just get beyond three generations.

Please speak to us if you have any concerns that your current financial arrangements are quite what you’d hope they’d be.

Roland Oliver

October 2013

Apathy or action – can you really afford to ignore your business vulnerabilities?

There is no question that business protection considerations are a hot topic right now.

There is no question that business protection considerations are a hot topic right now.

In the last few weeks there have been several discussions launched on Linkedin asking what small businesses are neglecting in terms of business protection and whether or not business owners are sticking their head in the sand when it comes to business protection.

There is a massive gap in the business protection market among UK business owners and some of the recent statistics from Legal & General in support of the Every Business Matters campaign on Unbiased.co.uk are quite staggering but not unsurprising.

There are just too many businesses out there who have insufficient or no cover in place to allow operations to continue on the death or serious illness of a shareholder, partner or key person.

I don’t think it’s fair to say business owners are sticking their head in the sand with regards to this issue, many are well aware of the seriousness of this level of risk and the financial havoc death or critical illness can bring on firm.

The issue is perhaps lack of guidance and education. Directors, Partners and Key People are busy doing what they do best on a day to day basis, growing their companies, developing their brand and making the venture a profitable as possible. Finding the time to discuss, consider and understand what their business protection needs are, is often a hard thing to do for no reason other than they are too busy doing other things.

Add to this, the general resistance amongst many advisers to sell business protection because they believe it is too complex or they don’t understand all the nuances of the cover and you have a great recipe for avoidance and apathy across the business sector.

I believe we have a responsibility to support business owners, to help them identify where their vulnerabilities lie and to explain the process to put the correct cover in place with the appropriate legal documentation.

It doesn’t have to be complicated or painful, taking the time to evaluate a business, identify key areas of risk and providing a solution is a tremendously rewarding exercise.

We have helped many businesses over the years to put the correct planning in place and time and again when the exercise is complete the owners reaffirm the process has given them a real peace of mind and sense of control. They feel able to move on with the day to day development of the business safe in the knowledge that all their hard work to create a business with value is underpinned with the correct protection.

If you have any concerns with respect to your business or you would simply like more information on business protection then we would love to hear from you.

Take action and don’t let apathy expose your business to unnecessary risk!

Dr C.

EU Gender Directive – 104 days to final deadline

A short while ago I blogged on the up and coming EU Gender Directive which will come into effect after 21st December 2012.

The deadline date is now fast approaching and we feel really there is no time like the present to shout again about these changes and the impact they will have on any cover you have in place or plan to do

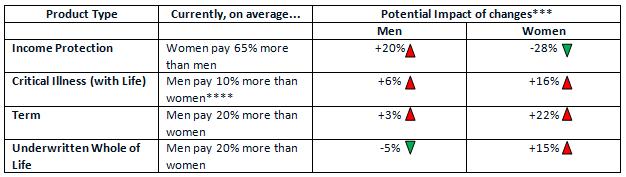

Just as a reminder, from 21 December 2012, the EU Gender Directive means that men and women will be treated the same when it comes to insurance premiums. Whilst also affecting car insurance and retirement annuities, the new European gender law will have significant repercussions for life, critical illness and income protection cover. The gender effect will result in most women having to pay more for life and critical illness – around 15%*, but less for income protection. Men, on the other hand might enjoy some reductions to the cost of life and critical illness cover, but pay more for income protection.

From January 2013, most life insurance companies will be required to pay more tax; raising more revenue for the Treasury, pushing up life insurance costs for insurers and ultimately their customers. Experts estimate this could increase costs by around 10%**, largely offsetting any wins from the gender changes.

The double whammy effect means that generally for both men and women the cost of protection is set to go up.

The extent of change will vary by provider, will differ by product class and be determined by the individual circumstances of the client. Added to this, we expect to witness a fair amount of re-pricing activity in early 2013 as providers attempt to get to grips with the new gender neutral world.

Liverpool Victoria have provided some useful figures which are based on their analysis of the entire market and some of the predictions made by key stakeholders and experts, and these are noted below to give you an idea of the potential impact this directive may have:

These statistics stand as a stark reminder that now is the time to act, particularly if you have cover on risk you want to review or increase or if you have been wavering on whether or not it’s the right time to look at applying for personal protection.

All applications submitted between now and the 20th December must be fully underwritten, accepted and on risk to avoid the new Directive and in our experience whilst most cases go through within 1-2 weeks some cases can take much longer depending on underwriting requirements and your personal circumstances.

Don’t fall foul of thinking there is still plenty of time, there are only 12 weeks to go until we are into December and we all know how quickly that will go!

We would strongly recommend if you want to review your cover or put new plans in place you should be taking action within the next 4 weeks to ensure you don’t miss out on current pricing.

Don’t delay any further get in touch for a protection review and ensure you’ve got the right cover for the right price.

Claire Armstrong

Sources: * HM Treasury, December 2011; ** Actuarial Profession, March 2012

***In some cases, women pay more than men

**** Adding together the estimates provided by LV=, June 2012 and Actuarial Profession, March 2012. The changes to costs will vary by individual, product and provider. They could be lower or higher than the average 16% indicated.

Death and Taxes

Business Protection Revisited

For all business owners when it comes to protecting the business the key considerations are continuity and succession.

On the temporary absence or loss of a key person business owners need to consider for how long (if at all) the business could continue to run efficiently and remain profitable. In addition to this they need to consider what plans are in place to ensure business assets are valued correctly and passed to the right people.

Businesses look to protect themselves against every eventuality, buying cover for their buildings, contents, materials and cars. However, the majority don’t cover their single biggest asset – their employees. According to research carried out by the British Chambers of Commerce in 2009, more than 60% of businesses have at least two key individuals. However, 44% of those surveyed said their businesses wouldn’t survive longer than 12 months if they lost one of these key people.

We touched on this subject in our blog last month and it is a subject we plan to revisit regularly as there continues to be a staggering need for companies to address this issue.

We’ve all heard at one time or other someone quote those famous worlds from Benjamin Franklin “In this world nothing can be said to be certain, except death and taxes”. Ask any business owner what concerns them when it comes to tax and they will most certainly respond that they want to ensure they maximise all available tax advantages and to have the correct accounting procedures in place to do so.

Why then do so many companies remain resistant when it comes to having the correct plans and procedures in place to ensure death or serious illness does not affect the daily running of the business?

Consider the likelihood of at least one partner/director in a firm dying before age 65*

| Age | Number of Partners/Directors | |||||

| 1 | 2 | 3 | 4 | 5 | 10 | |

| 35 | 7% | 13% | 19% | 25% | 30% | 51% |

| 40 | 7% | 13% | 18% | 24% | 29% | 49% |

| 45 | 6% | 12% | 17% | 23% | 27% | 47% |

| 50 | 6% | 11% | 16% | 21% | 25% | 44% |

Further to that consider the likelihood of at least one partner/director in a firm having a critical illness before age 65**

| Age | Number of Partners/Directors | |||||

| 1 | 2 | 3 | 4 | 5 | 10 | |

| 35 | 29% | 50% | 65% | 75% | 82% | 97% |

| 40 | 29% | 49% | 64% | 74% | 81% | 97% |

| 45 | 27% | 47% | 62% | 72% | 80% | 96% |

| 50 | 25% | 44% | 58% | 68% | 76% | 94% |

Are the percentages as you expected?

Whether you are a Limited Company, Sole Trader, Partnership or Limited Liability Partnership the threat of death or serious illness of a key person is very real and it doesn’t have to mean the end of a business you have worked hard to create and make profitable.

If you are considering (or know someone who should be considering) continuity or succession planning we can help with calculating the level of cover required, how to set up the arrangement and the tax implications associated with the premiums and benefits payable on these plans.

We have dedicated teams with 5 of the top Business Protection Providers who can help us help you put the right plans in place, allowing you to get on with making your business profitable without the worry of what happens if someone takes seriously ill or dies.

It isn’t as complex or as expensive as you might think, so don’t delay, get in touch with us today and let the Expert Team at Oliver Asset Management ensure your business goes from strength to strength safe in the knowledge your protection needs have been met and will be reviewed regularly.

We look forward to hearing from you.

Dr Claire Armstrong

Source: www.actuaries.org.uk/knowledge/cmi/cmi_tables

*Based on mortality data from TMN00 (temporary assured lives, male non-smokers, 1999-2002) at five or more years’ duration.

**CIBT02. Based on 1971-2003 population data and experience, published in SIAS paper Exploring The Critical Path, 2006. Males, stand-alone extended cover, including own occupation and total and permanent disability.

Business Protection – Can you identify a need and are you covered?

As of April this year there were over 2.5 million registered companies in the UK* and a staggering Business Protection gap defined by Legal & General as £1.1 trillion **.

44% of business owners said their businesses would fold within 12 months of the death or critical illness of a key person and only 4% of business owners have shareholder protection in place**.

If you are involved in a business small or large you will know that an integral part of the running costs includes insurance in relation to buildings and contents, key equipment, stock, vehicles and Public liability to name but a few.

The cost of each is taken as a given and paid regularly to ensure a business is functioning within the right legal requirements and to provide backup should the “worst” happen.

There is no doubt that equipment, vehicles, location etc provide the means by which a business can offer goods or services but what is the real backbone of any firm are the people who make it successful and profitable.

A successful business is one which not only makes the most of its key individuals but nurtures their expertise and reaps the reward in terms of the relationships they develop with suppliers and customers.

Have you considered the cost to your business if you were to lose one of your key individuals through ill health or death? If you can think of someone within the business whose temporary or permanent loss would affect the company’s ability to maintain turnover and generate profit then they are a key individual and they should be covered.

If you lose a Key Person from the firm you need to be able to cover the cost of recruitment and replacement for that individual as well as making up for loss of profit directly attributable to them. You may also require reserves in place to ensure any business liabilities such as overdrafts, business loans or even Directors Loan Accounts can be repaid if they are recalled.

Business Succession Planning

As well as Key Person cover there is a massive need for Shareholder Protection within firms, or more specifically Business Succession Planning.

Business Succession Planning not only protects the company but also the employees, their families and the shareholders.

Some of the most frequently asked questions for shareholders within a company when considering the death or critical illness of a co owner include:

- What happens to their shares when they suffer a serious illness or die?

- How would the control of the business change?

- What would be the cost of buying out the co-owner’s share?

- Where does the cash come from to purchase shares from the co-owners family if they do not wish to retain an interest in the business?

- What agreements can be put in place to ensure remaining shareholders and surviving families can exercise their preferred options when it comes to retaining or selling shares?

We can help answer these questions for you.

The partner, shareholders and key people in any business are its driving force, they are a valuable asset and you need to have plans in place that ensure if they suffer a critical illness or die your business can still continue and remain profitable despite the loss.

The death or critical illness of a key person in your company could threaten everything you’ve worked so hard to achieve, is it really worth the risk not to have the correct cover in place?

If you’re not sure where to begin then we can help. We can take you through a step by step guide which helps you consider who needs to be covered and for how much. In conjunction with this we will make you aware of the tax treatment of your premiums and benefits paid on any plans and talk you through the appropriate agreements which should be in place to ensure benefits are paid correctly.

It may seem like a minefield of information but we can pinpoint the need within your company and provide you with a complete report on what would be required and the monthly cost, incidentally it isn’t as much as you would think.

Whether you are a Sole Trader, Co-Owner, Partner or perhaps even a Key Person in a firm we will be able to talk you through the options and help you through the process from beginning to end. We also offer a regular review service and would revisit all your planning on an annual basis to ensure your protection planning is keeping pace with any business changes.

So don’t put off any longer, if you want to speak with us further about how to protect your Business then we’d love to hear from you.

Claire Armstrong

*www.companieshouse.gov.uk (as at 03/04/2011)

**www.legalandgeneralcomms.co.uk/businessprotection

The need for business succession planning

During a meeting with a business owner this week, I had the tables turned on me when she started a discussion about the relative merits of business protection plans.

Apart from fact that this is something I should have been doing, it did highlight that this business owner was thinking about the risks (dare I say it again, because of the current economic climate) to her personal circumstances if something was to happen to her fellow Director.

She did also allow me to regain control of the discussion as the understanding of the difference between Key Person Cover and Director’s Share Protection (and how they can overlap) wasn’t fully clear to her.

When you compare the statistics of the number of US businesses that have protection in place for their Key People and Directors to the UK, it shows the enormous financial risk many British business owners are prepared to take by not putting the proper arrangements in place.

A few throw away lines to highlight some of the issues:

“would you be happy if your biggest rival in business was able to buy into your firm because you hadn’t made sure your fellow Director’s shares were subject to the proper agreements in the event of death?”

“…if the most important fee earner in your business was diagnosed with cancer, would your bank be sympathetic to your request for increased overdraft facilities?”

There are a number of questions that owners of businesses should be asking themselves to highlight the potential need for some type of Business Protection cover.

I have set out a list of the major ones I think you must consider now in Key Questions for Business Protection.

If you need to discuss the implications of your answers to these questions and need professional guidance as to how to set the correct type of Business Protection arrangements for your firm up, please give me a call.

Roland Oliver