We are currently carrying out a large exercise for a client to ensure that the inheritance tax on her estate is mitigated as much as possible.

As well as taxation and trust work, the use of our cash flow modelling system has become an important part of this.

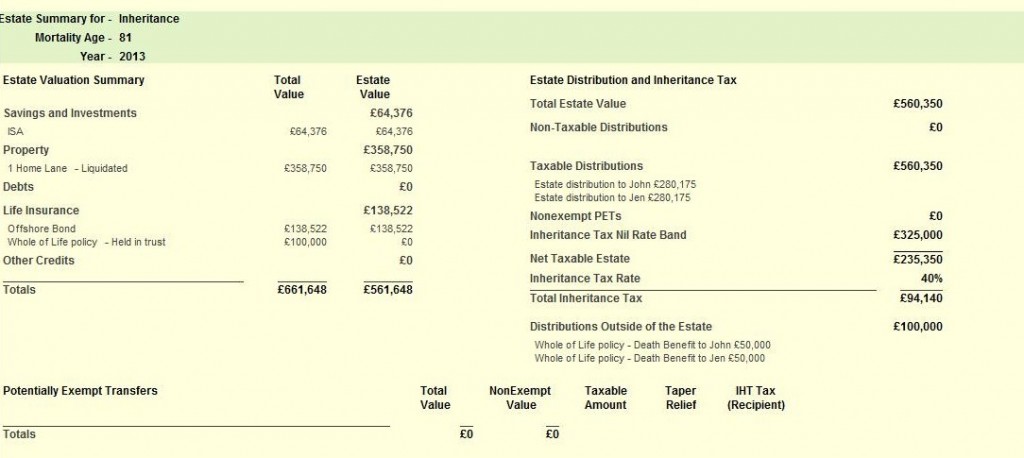

We are able to enter all of the client’s assets into the system and simulate an immediate estate scenario (a nice way of putting it!). This provides balance sheet style view of everything that needs to be taken into account, and performs the appropriate calculations. Any beneficiaries of the estate can also be entered into the planning, as well as potentially exempt transfers.

Please click on the image below for a basic example of this.

In this case, the estate will be distributed to two children, John and Jen. The system automatically collects anything that would be part of the estate and performs the calculations. This can be as simple or as complicated as necessary to correctly simulate your planning. The detail can drive down into the way certain policies are set up. For example, the Whole of Life insurance policy that the example client above holds is written in trust, and therefore the payment is outside of the estate.

The example above shows one solution in inheritance tax planning, whereby the £100,000 Whole of Life policy in trust pays out enough to cover the inheritance tax charge of £94,140.

For a detailed look at your inheritance tax position and to see what we can do for you please get in touch.

MS