A client said to me very recently that financial planning must be much easier right now as the performance of the World’s stock markets were in positive territory and values of holdings would be up.

He wanted to know what I was going to be saying to my clients in the coming months after several years of telling them to maintain discipline, stay invested and keep asset allocation true.

Well, pretty much the exact same story as he’s heard over the last few years is the answer!

He was also interested in my view of a particular story in the finance section of that morning’s paper  which was suggesting triple-dip recession was a heartbeat away and what steps should we take to avoid it…

which was suggesting triple-dip recession was a heartbeat away and what steps should we take to avoid it…

The headline writers are paid to try and get our attention and shouldn’t be used as a basis for making investment decisions.

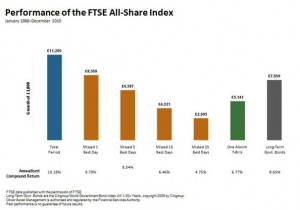

For the everyday investor, the lesson is that the closer you are to media and market noise, the harder it is for you to pay attention to the bigger picture.

Markets are moving constantly as news and information is built into prices. Sentiment is buffeted one way, then the other. Millions of participants make buy and sell decisions based on news or their own individual requirements.

The job of media and market analysts frequently boils down to creating plausible narratives around often disconnected events so that it all appears seamless. Then the next day, you start all over again.

As a broker or a journalist, whose horizons are in minutes, this approach to markets makes sense. But for investors with long-term horizons, second and third guessing money decisions based on the news of the day is unlikely to deliver sound results.

A better approach is to work with a trusted advisor in building a diversified portfolio of assets tailored for your needs and risk appetite. The portfolio is rebalanced regularly to match your requirements, not according to what is happening in the markets. Tactical asset allocation can sound tempting, but there is always a risk that the news overtakes you. Then you are left having to change everything all over again.

As a wise man once said, running inside a moving bus won’t get you to your destination any quicker.

Roland Oliver

At a time when many in the city may have just received their bonus and will be paying a healthy dose of tax with it, I thought it would be a good time to mention a couple of investment vehicles that come with tax relief.

At a time when many in the city may have just received their bonus and will be paying a healthy dose of tax with it, I thought it would be a good time to mention a couple of investment vehicles that come with tax relief.