Are you building a fund for your retirement in a company pension scheme? If so, forthcoming changes to the taxation of pension savings could cost you dearly – unless you act swiftly.

From April, the maximum pensions saving that anyone is allowed to build, before it becomes subject to punitive taxation, reduces from £1.5m to £1.25m. This cap is called the Lifetime Allowance (LTA) and applies to an individual’s entire pension savings (apart from the state pension).

The figure may sound high but many thousands of people fall into the category – especially those in final-salary schemes who have built their entitlement through many years’ work.

But don’t despair, if you are affected, there are actions you can take before April to mitigate the potential tax charge down the line.

Saving into a pension scheme has for years attracted tax relief. However it was felt that wealthy people were getting too much tax relief and building up enormous pension pots and the LTA was introduced at £1.8m in 2012 reducing to £1.5 in 2013 and now to £1.25m in April this year.

It would be a brave man that did not anticipate further reductions in years to come.

When first introduced, the LTA used to apply only to a few thousand high earners in the UK who could afford to grow seven-figure pension pots. But the reduction in the limit, coupled with the increased costs of funding retirement promises for those who retire on final-salary-type pensions, has now pushed hundreds of thousands of people into the net.

There is some key information you need to know or find out quickly!

You need to find out what the total value of your pension savings will be, as at April 2014. This should include any legacy pension schemes with previous employers. If the total is already over £1.25m, or likely to grow beyond that sum before retirement, you can take action to retain the £1.5m LTA, subject to certain conditions.

If you are in a final salary scheme and expect to receive a pension in excess of £56,000 on retirement, this could take you over the LTA and should prompt you to take action now.

As ever HMRC have produced detailed guidance on the changes and impacts (see link below) but if you need assistance to understand the impact on you then please get in touch.

HMRC http://www.hmrc.gov.uk/pensionschemes/understanding-la.htm

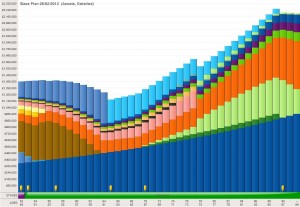

We can enter in information such as your incomes, expenses, assets and liabilities and model forward projections, such as those seen on the right.

We can enter in information such as your incomes, expenses, assets and liabilities and model forward projections, such as those seen on the right. Combining this with expert advice that guides you through an all encompassing view of your current circumstances, maybe you can generate some of your own luck.

Combining this with expert advice that guides you through an all encompassing view of your current circumstances, maybe you can generate some of your own luck.

Our job is then to become custodian of the wealth, provide sensible investment strategies and use the tax advantages of various “wrappers” to keep the clients in the style to which they’d like to become accustomed!

Our job is then to become custodian of the wealth, provide sensible investment strategies and use the tax advantages of various “wrappers” to keep the clients in the style to which they’d like to become accustomed!