A short while ago I blogged on the up and coming EU Gender Directive which will come into effect after 21st December 2012.

The deadline date is now fast approaching and we feel really there is no time like the present to shout again about these changes and the impact they will have on any cover you have in place or plan to do

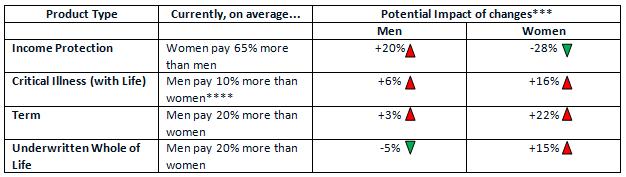

Just as a reminder, from 21 December 2012, the EU Gender Directive means that men and women will be treated the same when it comes to insurance premiums. Whilst also affecting car insurance and retirement annuities, the new European gender law will have significant repercussions for life, critical illness and income protection cover. The gender effect will result in most women having to pay more for life and critical illness – around 15%*, but less for income protection. Men, on the other hand might enjoy some reductions to the cost of life and critical illness cover, but pay more for income protection.

From January 2013, most life insurance companies will be required to pay more tax; raising more revenue for the Treasury, pushing up life insurance costs for insurers and ultimately their customers. Experts estimate this could increase costs by around 10%**, largely offsetting any wins from the gender changes.

The double whammy effect means that generally for both men and women the cost of protection is set to go up.

The extent of change will vary by provider, will differ by product class and be determined by the individual circumstances of the client. Added to this, we expect to witness a fair amount of re-pricing activity in early 2013 as providers attempt to get to grips with the new gender neutral world.

Liverpool Victoria have provided some useful figures which are based on their analysis of the entire market and some of the predictions made by key stakeholders and experts, and these are noted below to give you an idea of the potential impact this directive may have:

These statistics stand as a stark reminder that now is the time to act, particularly if you have cover on risk you want to review or increase or if you have been wavering on whether or not it’s the right time to look at applying for personal protection.

All applications submitted between now and the 20th December must be fully underwritten, accepted and on risk to avoid the new Directive and in our experience whilst most cases go through within 1-2 weeks some cases can take much longer depending on underwriting requirements and your personal circumstances.

Don’t fall foul of thinking there is still plenty of time, there are only 12 weeks to go until we are into December and we all know how quickly that will go!

We would strongly recommend if you want to review your cover or put new plans in place you should be taking action within the next 4 weeks to ensure you don’t miss out on current pricing.

Don’t delay any further get in touch for a protection review and ensure you’ve got the right cover for the right price.

Claire Armstrong

Sources: * HM Treasury, December 2011; ** Actuarial Profession, March 2012

***In some cases, women pay more than men

**** Adding together the estimates provided by LV=, June 2012 and Actuarial Profession, March 2012. The changes to costs will vary by individual, product and provider. They could be lower or higher than the average 16% indicated.