As part of the Wealth Management service we offer a comprehensive look at your entire financial position. If you have significant assets, an important part of your planning is the future of your estate in the event of your death. This entails the obvious legal aspects such as having a will prepared but also how exactly these assets are arranged.

The basic things to consider are as follows:

– Inheritance tax is only due if your estate – including any assets held in trust and gifts made within seven years of death is valued over the current inheritance tax threshold (£325,000 in 2012-13 tax year).

– Tax is paid at 40% on the amount over this threshold

– Since October 2007, married couples and registered civil partners can effectively increase the threshold on their estate when the second partner dies – to as much as £650,000 in 2012-13. Their executors or personal representatives must transfer the first spouse or civil partner’s unused Inheritance Tax threshold or ‘nil rate band’ to the second spouse or civil partner when they die.*

Step one when producing an estate solution is to model your complete financial situation. This allows us to not only calculate what your immediate legacy or joint immediate legacy is, but also what it is likely to be factoring in rates of income and expenditure, as well as growth and inflation over time.

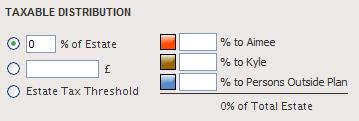

With this in place we can firstly analyse whether there is an inheritance tax liability at all. If there is, we will also be able to quantify just what this liability is and also, if desired, designate the estate split amongst other members of the plan.

The calculations are presented in a detailed report. Once the liability is recognised we can then start to prepare what the best solution or solutions will be in discussion with the client, from gifting strategies to whole of life insurance policies.

You don’t have to be planning on leaving an inheritance to make the most of these tools. For some clients we have been able to take a different approach; how much can they afford to spend annually to make the most of their assets and gradually exhaust them? By adding in an arbitrary expense we can make an estimate. We can carry this out on a worst case scenario basis as well.

This approach takes a lot of the uncertainty out of inheritance tax planning and is of great benefit to our clients in this stage of their lives.

If you feel that this side of your planning hasn’t been looked at appropriately please get in touch. We offer a free second opinion service to anyone unsure about their current plans.

* Legislation from HMRC correct at the time of writing.