There have been two recent conversations of late that serve to illustrate the worrying lack of understanding of how much retirement might cost.

The first was from someone wondering how we might get more income from his retirement pot. Put more money in I said, not entirely tongue-in-cheek.

Secondly, a young woman said she would save what was left of her income once her bills were paid and her “fun” money was set aside.

I’m not sure you can owe your pension plan the contributions, but you get the picture.

This from the MetLife 2011 Retirement IQ:

“2011 shows a significant increase of respondents who say that the greatest financial risk facing retirees is longevity. Sixty-two percent of respondents answered correctly in 2011, compared to 56% in 2008, and 23% in 2003.”

I’m genuinely concerned that our mighty Financial Services industry has not managed to get the message to the public that you need to plan to stop work and that you’ll need money to do it.

It’s a pretty simple concept and to take more from the MetLife’s Mature Market Institute research, even if people are prudent, sensible and save for retirement, longevity and market risk are leading to generations that will run out of cash before they have the good grace to die.

Whichever way you slice it, a large dose of reality has to be brought to bear when doing retirement planning for clients.

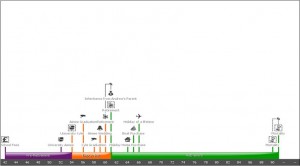

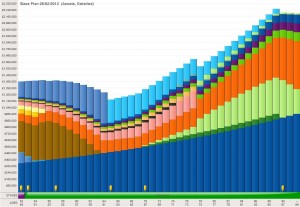

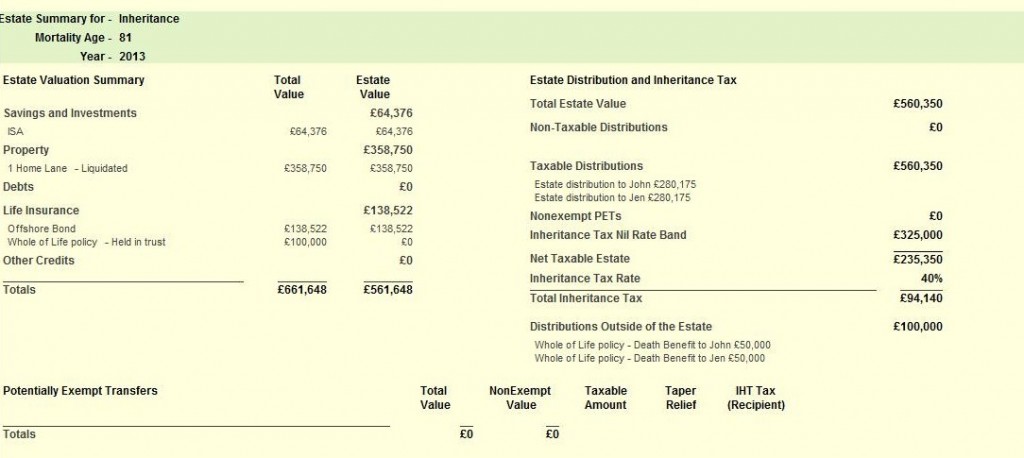

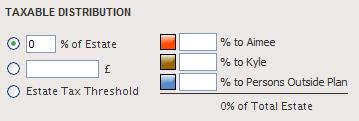

Wealth modelling plays a great part in determining the numbers, (Voyant is our system of choice) but it has really struck me that we, as financial planners, have a huge burden of responsibility to make clients aware of what’s involved in getting to your “number”

Taking this a stage further I got to thinking about whether we work with our clients, for our clients or do we take orders?

I’m sure we are more in category one and two rather than three, but it requires a genuine want to get involved at much more personal level.

David Jones of Dimensional Fund Advisers recently mentioned to me the idea of the one number on the fridge door that should anything happen to the couple, the family could ring the phone number and person on the other end of the phone would understand and be able to sort out the financials.

Does your current financial adviser educate you, train you and make you do what you need to get to retirement in the shape you need to be?

And is he or she your trusted number on the fridge door?

I know Shane Mullins of Fiscal Engineers of Nottingham is rightly focussing on the “trust” part of the relationship between client and adviser and I too believe that this is the key part of our makeup.

I await his tweets with further interest.

So what am I saying?

Guiding clients to retirement requires reality, discipline and commitment from clients and a desire from the adviser to understand the client and their family’s needs and be seen as someone who can be trusted to deliver the plan.

We can’t get to the numbers until we put the time in to establish a relationship with the client that’s based on mutual respect and understanding.

So when your adviser tells you to put more money into your retirement plans because he thinks it is a good idea and it will benefit you and not him, you know you’ve got the right man and can post his number on your fridge.

We need to make the public understand that there is a big difference between going to see someone who will sell you a pension (insert you own local favourite or bank here) to working with trusted adviser who will have a genuine interest in helping you retire in good shape.

One final point; MetLife research would point to income guarantees being very important in retirement for clients and with the continued erosion of annuity purchasing power, is this the way forward?

0131 273 5202 – Cut out and stick on fridge.

Roland Oliver

We can enter in information such as your incomes, expenses, assets and liabilities and model forward projections, such as those seen on the right.

We can enter in information such as your incomes, expenses, assets and liabilities and model forward projections, such as those seen on the right. Combining this with expert advice that guides you through an all encompassing view of your current circumstances, maybe you can generate some of your own luck.

Combining this with expert advice that guides you through an all encompassing view of your current circumstances, maybe you can generate some of your own luck.