George Osborne revealed his mid-term budget on Wednesday 20th. Here is our summary of the most relevant points for your future financial planning:

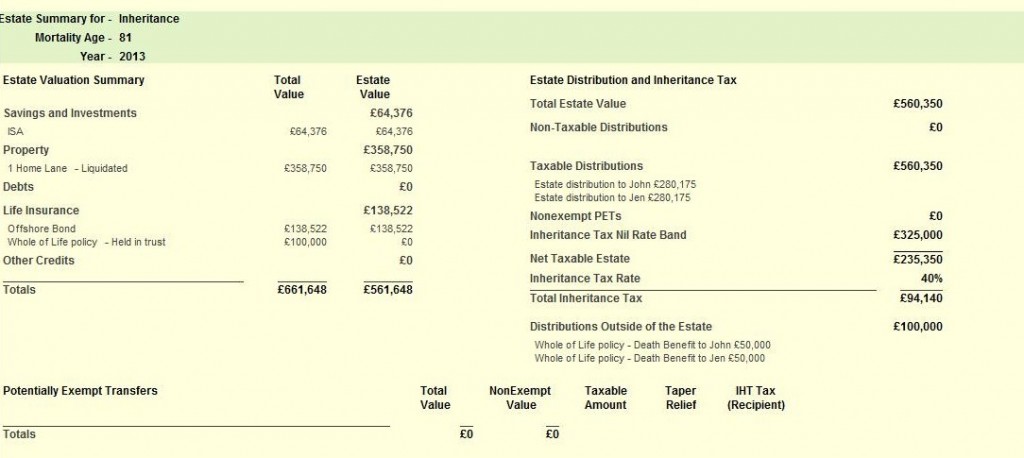

Inheritance tax – As mentioned in our blog recently, the amount of an estate that can be passed to the next generation tax free will remain at £325,000 until April 2018 (anything above being taxed at 40%). Another 5,000 estates are expected to become taxpaying estates by this time. If this is you, careful use of allowances today can reduce your bill.

State pension – this will rise by 2.5% to £110.15 per week. The Basic State pension and State Second Pension will be combined in April 2016 to a flat £144 per week (in today’s money). This should make it easier to plan for the future.

Pension drawdown – From Tuesday 26th March capped income drawdown rates will rise from 100% to 120% of GAD. While this could be useful for those of you that need more income, please be aware there is no guarantee your pension fund can sustain this. GAD is also set to be overhauled which should lead to good news in the future.

Capital gains tax allowance – the amount of gains that you can make on disposal of assets before having to pay tax increases to £10,900 for 2013/14. The rate remains at 18% for non and basic rate taxpayers, 28% for higher rate taxpayers.

ISA (tax free savings vehicle) – The stocks and shares ISA allowance will be £11,520 and the cash ISA allowance will be £5,760 in 2013/14. Please contact us for details of how you could use these depending on your circumstances. If you are yet to use your £11,280 allowance for 2012/13 contact us ASAP!

Income Tax – The personal allowance, currently £8,105, will increase to £9,440 in April this year and then £10,000 in April 2014.

Pension allowances will be cut next year – Personal annual contribution allowance down from £50,000 to £40,000 and lifetime allowance down to £1.25m.

Abusive tax avoidance – The Government will publish a report on how it will tackle tax avoidance and evasion this week. Needless to say, any tax mitigation strategies recommended by OAM are not abusive and are a key part of good financial planning.

That concludes our non-exhaustive list of points to be taken from Wednesday’s budget. The above points are based solely on our understanding of intended HMRC rules and should not be used to influence planning decisions on their own.

If you are a current client and require any clarification on how the above might affect you then please get in touch.

If you are not, then we would be happy to give you a second opinion on any aspect of your planning. There’s never been a better time to contact us.

Malcolm Stewart