Introduction

This week we are delighted to post an inspirational guest blog by Martin Stepek – award winning and critically acclaimed poet and writer and current CEO of the Scottish Family Business Association.

This week we are delighted to post an inspirational guest blog by Martin Stepek – award winning and critically acclaimed poet and writer and current CEO of the Scottish Family Business Association.

www.martinstepek.com

www.twitter.com/martinstepek

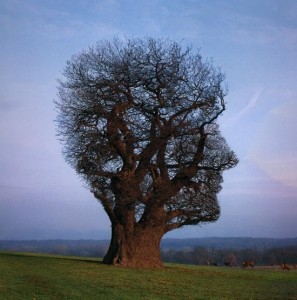

The Mindful Way of Doing Business

So what does a contemplative practice developed 2500 years ago by the Buddha have to do with your business? Surprisingly a lot actually, and even more importantly, in some of the key areas of your working – and personal – life.

Mindfulness is the technique of trying to catch each moment in its entirety, without the usual inner commentary or opinion we all tend to have. So it could be just reading an email calmly and carefully, without prejudging its overall contents because of a) who the sender is, or b) our opinion halfway through the message. Or it might be becoming aware of tiredness or irritation inside our mind during an important meeting (and let’s face it if it’s not an important meeting why are you having one?)

Mindfulness is the technique of trying to catch each moment in its entirety, without the usual inner commentary or opinion we all tend to have. So it could be just reading an email calmly and carefully, without prejudging its overall contents because of a) who the sender is, or b) our opinion halfway through the message. Or it might be becoming aware of tiredness or irritation inside our mind during an important meeting (and let’s face it if it’s not an important meeting why are you having one?)

Mindfulness also refers to the more formal practice of sitting, eyes closed but alert, and focusing clearly but lightly on the breath or on a particular thought or emotion.

We can practice mindfulness literally anywhere or while doing any activity. It’s the ultimate portable gadget. I do it while waiting for a train, while doing the ironing or the washing up, even when I first wake up before I’m out of bed.

But why should you be doing it? And believe me you should!

Mindfulness helps us in two ways; one the prevention of negative stuff, the other the cultivation of positive stuff. I use stuff deliberately as there’s a whole range of things that mindfulness concerns and affects.

Let’s look at the negatives. I don’t know anyone in business who isn’t sometimes affected by stress, 24/7 work, tiredness, frustration, niggles, irritation or anger, down to the really serious stuff of chronic anxiety, clinical depression or a sense that the work you do is shallow, unfulfilling, meaningless… and that somehow you’re missing out on the important things in life. Mindfulness deals with all this… yes it’s “stuff” isn’t it? I’ll show evidence in a moment but let’s look at the positives now.

Mindfulness develops our sense of calm focus, clarity of thinking, creativity and compassion. It enables us to remain clear-minded under pressure, make decisions more wisely, and get home at the end of the day still capable of having a true relationship. How practical is this in running a business, in living a full life? I’d argue that apart from cash flow this good “stuff” is the most important set of features a business must have to succeed.

And the evidence? There are now over 2500 scientific journal articles on these effects, from the world’s leading universities; Oxford (has a mindfulness centre), Harvard, Yale, UCLA. Glasgow University has done ground-breaking research on mindfulness, and Aberdeen University offers an MSc. The internet is awash with papers, books, podcasts, interviews and lectures. Check them out.

I’ve been practicing since 1998, teaching it since 2004, to businesses, charities, social enterprises, schools, even Shotts Prison. I teach a free drop-in class on Tuesday evenings at 6.30-7.30pm at the University of West of Scotland in my home town of Hamilton. Mindfulness has helped me lead a national business support organisation, publish an award-winning reflection on my father as a Soviet labour camp victim, and much more beside, while still hopefully being a happy, contented and loving father, husband and friend.

As I said, you really should try it!

Our job is then to become custodian of the wealth, provide sensible investment strategies and use the tax advantages of various “wrappers” to keep the clients in the style to which they’d like to become accustomed!

Our job is then to become custodian of the wealth, provide sensible investment strategies and use the tax advantages of various “wrappers” to keep the clients in the style to which they’d like to become accustomed!

As the tributes rightly fly in for Sir Alex Ferguson, the most successful manager of our time, consider his value to the business over the last 26 years.

As the tributes rightly fly in for Sir Alex Ferguson, the most successful manager of our time, consider his value to the business over the last 26 years. 30+ years in financial services is certainly enough time to have seen a thing or two in the investment markets.

30+ years in financial services is certainly enough time to have seen a thing or two in the investment markets. of stock they would like to know if I would settle for 12 SRIXON AD333 golf balls. At the end of my tether I said yes, it suddenly didn’t feel like such a victory, I think I might have even gained the odd grey hair through the whole dire process.

of stock they would like to know if I would settle for 12 SRIXON AD333 golf balls. At the end of my tether I said yes, it suddenly didn’t feel like such a victory, I think I might have even gained the odd grey hair through the whole dire process.

membership with a certain motoring organisation had been rewarded recently by the offer of a Gold Membership.

membership with a certain motoring organisation had been rewarded recently by the offer of a Gold Membership.