Interesting article from Dimensional Fund Advisers on the constant on-going need to try and forecast what may or may not happen in investment markets

End of Year Tax Planning – Time to think again about VCTs and EIS ?

With further changes to Pensions legislation reducing the Pension Lifetime Allowance (LTA) from £1.5m to £1.25m and the maximum annual contribution from £50k to £40k, more and more people have to look for alternative solutions to investment and tax planning. Continue reading “End of Year Tax Planning – Time to think again about VCTs and EIS ?”

Plan now to avoid a big tax bill on your pension savings.

Are you building a fund for your retirement in a company pension scheme? If so, forthcoming changes to the taxation of pension savings could cost you dearly – unless you act swiftly.

From April, the maximum pensions saving that anyone is allowed to build, before it becomes subject to punitive taxation, reduces from £1.5m to £1.25m. This cap is called the Lifetime Allowance (LTA) and applies to an individual’s entire pension savings (apart from the state pension).

The figure may sound high but many thousands of people fall into the category – especially those in final-salary schemes who have built their entitlement through many years’ work.

But don’t despair, if you are affected, there are actions you can take before April to mitigate the potential tax charge down the line.

Saving into a pension scheme has for years attracted tax relief. However it was felt that wealthy people were getting too much tax relief and building up enormous pension pots and the LTA was introduced at £1.8m in 2012 reducing to £1.5 in 2013 and now to £1.25m in April this year.

It would be a brave man that did not anticipate further reductions in years to come.

When first introduced, the LTA used to apply only to a few thousand high earners in the UK who could afford to grow seven-figure pension pots. But the reduction in the limit, coupled with the increased costs of funding retirement promises for those who retire on final-salary-type pensions, has now pushed hundreds of thousands of people into the net.

There is some key information you need to know or find out quickly!

You need to find out what the total value of your pension savings will be, as at April 2014. This should include any legacy pension schemes with previous employers. If the total is already over £1.25m, or likely to grow beyond that sum before retirement, you can take action to retain the £1.5m LTA, subject to certain conditions.

If you are in a final salary scheme and expect to receive a pension in excess of £56,000 on retirement, this could take you over the LTA and should prompt you to take action now.

As ever HMRC have produced detailed guidance on the changes and impacts (see link below) but if you need assistance to understand the impact on you then please get in touch.

HMRC http://www.hmrc.gov.uk/pensionschemes/understanding-la.htm

Rags to Rags in Three Generations (and how to avoid it!)

It’s a well-worn phrase that I’m sure you’ve heard before.

The grandparents start the business, it becomes successful, the next generation build it further and the grandchildren subsequently ruin it and squander the wealth.

Of course it doesn’t happen this way every time. When we look at our typical client profile we see a great similarity – Families running businesses trying to build better lives for the future generations. And leave a lasting legacy.

We have developed what I guess market-teers would call a strap-line for our business that explains what we do – “We look after families, their businesses and their wealth across the generations”

By identifying this particular niche we can see that there are common financial planning requirements that come up frequently. That’s not to say that each situation is not unique but there are similarities in what each family is trying to achieve financially.

We find that we are often referred up and down the family generations and it really helps when there is family understanding and consensus when building the financial plan. Using our cash flow modelling process also provides a long term view of how wealth and indeed the value built up in the business can help families for a great number of years.

We can establish when it might be right to exit a business and extract wealth tax efficiently for the current generation while leaving a viable firm for the next generation.

We strongly believe that as family wealth financial planners we need to take a much longer view of our clients and consider 40 years, 50 years and even longer relationships.

Taking a cross-generational view also helps with our passively engineered investment approach by allowing capital markets to reward you for investing over the much longer term. You can let the beauty of compound returns achieve the family financial goals without exposing yourself to unnecessary risk.

In other words, if 5% pa or 6% pa return over the next 30 years gets you there, then don’t aim for 10% pa and find you are exposed to greater volatility and portfolio value swings than you’d like to be.

Being smart across generations with robust tax-planning can also provide greater wealth for the family and taxes such Inheritance Tax, can be mitigated or avoided altogether by taking the long term view.

Protecting the family and the business by using third-parties to shoulder the risk if something happening to the driving family member is vitally important and again something that should be known and understood by the family group. There is little point in creating wealth only to have is lost on the death or serious illness of one individual family member.

From a cost point of view, there are other benefits to this approach. There are often family discounts to be had by pooling assets on an investment platform – we do this through our Personal Investment Account and it can lead to substantially reduced costs that apply to all members of the family group over a long period of time.

I hear that slow-cooking is now become the natural antidote to fast-food and perhaps it’s time to apply this approach to your financial planning – easy does it, take long term considered views and we might just get beyond three generations.

Please speak to us if you have any concerns that your current financial arrangements are quite what you’d hope they’d be.

Roland Oliver

October 2013

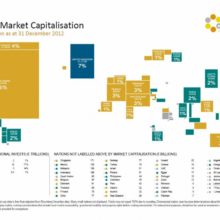

World Market Capitalisation

Viewing the world map by relative market capitalisation illustrates the importance of building a globally diversified portfolio and avoiding a home market bias.

This cartogram, produced by Dimensional Fund Advisors, depicts the world not according to land mass, but by the size of each country’s stock market relative to the world’s total market value (free-float adjusted).

Population, gross domestic product, exports, and other economic measures may influence where people invest. But the map offers a different way to view the universe of equity investment opportunities. If markets are efficient, global capital will migrate to destinations offering the most attractive risk-adjusted expected returns. Therefore, the relative size and growth of markets may help in assessing the political, economic, and financial forces at work in countries.

The cartogram brings into sharp relief the investible opportunity of each country relative to the world. It avoids distortions that may be created or implied by attention to economic or fundamental statistics, such as population, consumption, trade balances or GDP.

By focusing on an investment metric rather than on economic reports, the chart further reinforces the need for a disciplined, strategic approach to global asset allocation. Of course, the investment world is in motion, and these proportions will change over time as capital flows to markets offering the most attractive returns.

MS

Golf, Psychology & Andy Murray

OK, I’ve not blogged in a while and to ease myself back into the fray, a little light piece for openers.

We recently had a networking golf day at my own club Craigielaw and as part of the fun we had a sports psychologist talk to the group before playing our round.

He talked about the winning mind set displayed by top sports people and to help us perform better during our game of golf, he asked us to use the acronym WIN (What’s Important Now) as a way of focusing not on what had gone before or was to come, but the now.

The chat after the game was how much better people had played and that they attributed this in part to the WIN idea.

Our overall winner from the day was an ex-Liverpool and Scotland footballer who, despite advancing years, still has that mental edge and desire to win.

He scored over 50 Stableford points (yes over 50!) and had we been able to randomly drug test him, would probably tested positive for several banned horse steroids and supplements.

He knows who he is and the handicap committee has him firmly in their sights…

Anyway, the link to top performance and mental attitude is clear.

As so to our Andy.

I wonder how many times Andy Murray’s name has been mentioned around the collective water coolers of the UK?

An incredible result (only spoiled for me by Alex Salmond’s shameless posturing with the Saltire…) and an amazing display on mental control and desire to win which he’s carried with him all through his career.

He also showed patience beyond his years in dealing with quite simply some of the most fatuous interview questions ever posed.

During one sledgehammer attempt to subtly link a visiting Sir Alex Ferguson to his difficult semi-final encounter with Verdasco, the interviewer suggested he may be due the hairdryer treatment from Ivan Lendl after his performance.

“…But I pulled back a two sets deficit to win the game and wouldn’t deserve the hairdryer” was his succinct putdown.

It does seem the BBC still hankers after the golden era when Fred Perry was in his pomp and gentlemen quite rightly wore long trousers on court.

If you’ve tuned in to find some clever link between my ramblings and the current machinations in Financial Services, prepare for disappointment.

Roland Oliver

8th July 2013

What would you do with £381m?

The news over the past day has informed us of the largest ever undivided lottery win the United States of $590m (£381m), going to an 84-year old widow.

Talk of the lottery is nearly always accompanied by a discussion of what you would do with the winnings…

But after you have stopped considering how to furnish the gatehouse, it is worth remembering that it doesn’t have to be a massive lottery win for your money to require due consideration.

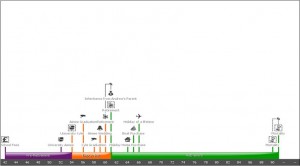

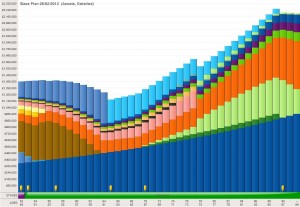

Using our cash flow modelling tool, Voyant, we can create a wide variety of what if scenarios that project forward how different choices today can affect your financial outlook tomorrow.

We can enter in information such as your incomes, expenses, assets and liabilities and model forward projections, such as those seen on the right.

We can enter in information such as your incomes, expenses, assets and liabilities and model forward projections, such as those seen on the right.

Being at the age Gloria, the 84 year old jackpot winner, is she chose to take her winnings as a lump sum rather than 30 annual payments of £12m. Taking it in this manner reduced the sum to £240million.

This type of situation is similar to those faced by retirees and those made redundant every day as they must decide how best to take their benefits. This is exactly the situation where cash flow modelling can shine.

Combining this with expert advice that guides you through an all encompassing view of your current circumstances, maybe you can generate some of your own luck.

Combining this with expert advice that guides you through an all encompassing view of your current circumstances, maybe you can generate some of your own luck.

Of course, if you are feeling lucky, we can even model a scenario where you win big…

How we can change your life this week

Much of human understanding of the world is built on models that attempt to recreate complex systems in a simpler form. This ranges from the reactions of the economy to a reduction in government expenditure to the effect of CO2 on climate change.

No model will ever be perfect as there are too many intricate relationships at play, but I am sure that most would agree that we are better to have some understanding of how these systems work than nothing at all.

Now let’s consider financial planning. It is one of those disciplines that, whether you are interested or not, it still applies to you. Every single person reading this blog will, in the simplest sense, have things they want to do, a number of years ahead of them, and an exhaustible amount of money flowing in and out.

There are different attitudes to this problem. Apathy is one. Some may not want to think about it because it will stop all of today’s fun. Some may have a vague idea it will all work out. Some people may have fashioned a rudimentary spreadsheet in Excel to try and boil the situation down into hard numbers, but once the projections involve discounted values of future contributions and the timescale stretches out, things can get complicated very quickly.

There are different attitudes to this problem. Apathy is one. Some may not want to think about it because it will stop all of today’s fun. Some may have a vague idea it will all work out. Some people may have fashioned a rudimentary spreadsheet in Excel to try and boil the situation down into hard numbers, but once the projections involve discounted values of future contributions and the timescale stretches out, things can get complicated very quickly.

At OAM, equipped with the market leading cash flow modelling software, Voyant, we can produce charts, projections, balance sheets and inheritance tax ledgers. We can put in key events such as weddings and the sale of a business. We can even kill you off next year, just to see what happens. We can tweak every assumption that lies behind the model to make it as realistic to your circumstances, and the wider economy, as is possible.

The level of detail is quite astonishing. Every change from HMRC on future tax rates are factored into models automatically, within days of announcement.

This week we made a big difference to a couple’s life, confirming that which they suspected: they don’t actually need to work anymore. They have accumulated more than enough to last comfortably until their assumed mortality age (itself selected by the client on the grounds of family history and the Office of National Statistics).

In the past we have helped clients assess their inheritance tax liability, choose between different redundancy options, set the amount of savings contributions required to pay for their children’s education and more.

In the past we have helped clients assess their inheritance tax liability, choose between different redundancy options, set the amount of savings contributions required to pay for their children’s education and more.

As stated above, every model has its limitations, but it is worth coming to see us to gain some understanding of how your future looks rather than earning and spending money in the dark. And as we see confirmed every day when small tweaks are made to client’s plans, a change today can make life quite different in 20 years.

Malcolm Stewart

It won’t get better if you pick it

Anyone with teenage kids will be familiar with the headline above; stop picking, scratching, fiddling and generally messing about otherwise it will never heal up!

Time for a tenuous link – “What’s investing got to do with pubescence and hormones?” I hear you cry…

Well, as passive strategy investors, the idea of getting the appropriate risk-rated asset allocation right, keeping costs low and maintaining discipline is at the heart of our philosophy.

We picked up a new follower on Twitter today (for which I’m grateful) and for reasons which should become apparent, I won’t mention their name…

In essence it was (yet) another business offering guidance to my business on how to create investment strategies for clients that I think were based around “over 20 years of experience” and some very fancy software designed to spot/recognise trends/sectors that should be the best performing etc etc.

Their website makes some bold claims and some interesting references to Warren Buffet but overall I was confused as to what the point was.

All in all it seemed like another company trying to prove that by using their methodology, philosophy and gee-whiz technobabble, you can get better results from you investments.

I suggest doing less and trusting to more simple understandings will work far better.

The Chinese philosophy of Taosim has a word for it: “Wuwei”. It literally means “non-doing”. In other words, the busier we are with our long-term investments and the more we tinker, the less likely we are to get good results.

The Chinese philosophy of Taosim has a word for it: “Wuwei”. It literally means “non-doing”. In other words, the busier we are with our long-term investments and the more we tinker, the less likely we are to get good results.

That doesn’t mean, by the way, that we should do nothing whatsoever. But it does mean that the culture of “busyness” and chasing returns promoted by much of the financial services industry and media can work against our interests.

Investment is one area where constant activity and a sense of control are not well correlated. Look at the person who is forever monitoring his portfolio, who fitfully watches business TV or who sits up at night looking for share tips on social media.

In Taoism, by contrast, the student is taught to let go of factors over which he has no control and instead go with the flow. When you plant a tree, you choose a sunny spot with good soil and water. Apart from regular pruning, you leave the tree to grow.

So we can’t control movements in the market. We can’t control news. We have no say over the headlines that threaten to distract us.

But each of us can control how much risk we take. We can diversify those risks across different assets, companies, sectors and countries. We do have a say in the fees we pay. We can influence transaction costs. And we can exercise discipline when our emotional impulses threaten to blow us off course.

I think I may have finally got my point across; to get a better investment experience, talk to us about our investment approach and don’t pick at your current one in the meantime!

Apathy or action – can you really afford to ignore your business vulnerabilities?

There is no question that business protection considerations are a hot topic right now.

There is no question that business protection considerations are a hot topic right now.

In the last few weeks there have been several discussions launched on Linkedin asking what small businesses are neglecting in terms of business protection and whether or not business owners are sticking their head in the sand when it comes to business protection.

There is a massive gap in the business protection market among UK business owners and some of the recent statistics from Legal & General in support of the Every Business Matters campaign on Unbiased.co.uk are quite staggering but not unsurprising.

There are just too many businesses out there who have insufficient or no cover in place to allow operations to continue on the death or serious illness of a shareholder, partner or key person.

I don’t think it’s fair to say business owners are sticking their head in the sand with regards to this issue, many are well aware of the seriousness of this level of risk and the financial havoc death or critical illness can bring on firm.

The issue is perhaps lack of guidance and education. Directors, Partners and Key People are busy doing what they do best on a day to day basis, growing their companies, developing their brand and making the venture a profitable as possible. Finding the time to discuss, consider and understand what their business protection needs are, is often a hard thing to do for no reason other than they are too busy doing other things.

Add to this, the general resistance amongst many advisers to sell business protection because they believe it is too complex or they don’t understand all the nuances of the cover and you have a great recipe for avoidance and apathy across the business sector.

I believe we have a responsibility to support business owners, to help them identify where their vulnerabilities lie and to explain the process to put the correct cover in place with the appropriate legal documentation.

It doesn’t have to be complicated or painful, taking the time to evaluate a business, identify key areas of risk and providing a solution is a tremendously rewarding exercise.

We have helped many businesses over the years to put the correct planning in place and time and again when the exercise is complete the owners reaffirm the process has given them a real peace of mind and sense of control. They feel able to move on with the day to day development of the business safe in the knowledge that all their hard work to create a business with value is underpinned with the correct protection.

If you have any concerns with respect to your business or you would simply like more information on business protection then we would love to hear from you.

Take action and don’t let apathy expose your business to unnecessary risk!

Dr C.