Much of human understanding of the world is built on models that attempt to recreate complex systems in a simpler form. This ranges from the reactions of the economy to a reduction in government expenditure to the effect of CO2 on climate change.

No model will ever be perfect as there are too many intricate relationships at play, but I am sure that most would agree that we are better to have some understanding of how these systems work than nothing at all.

Now let’s consider financial planning. It is one of those disciplines that, whether you are interested or not, it still applies to you. Every single person reading this blog will, in the simplest sense, have things they want to do, a number of years ahead of them, and an exhaustible amount of money flowing in and out.

There are different attitudes to this problem. Apathy is one. Some may not want to think about it because it will stop all of today’s fun. Some may have a vague idea it will all work out. Some people may have fashioned a rudimentary spreadsheet in Excel to try and boil the situation down into hard numbers, but once the projections involve discounted values of future contributions and the timescale stretches out, things can get complicated very quickly.

There are different attitudes to this problem. Apathy is one. Some may not want to think about it because it will stop all of today’s fun. Some may have a vague idea it will all work out. Some people may have fashioned a rudimentary spreadsheet in Excel to try and boil the situation down into hard numbers, but once the projections involve discounted values of future contributions and the timescale stretches out, things can get complicated very quickly.

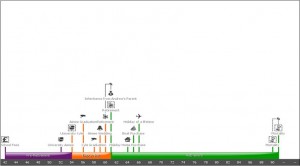

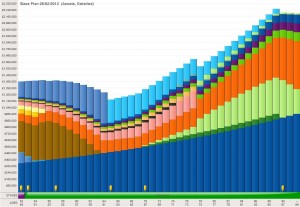

At OAM, equipped with the market leading cash flow modelling software, Voyant, we can produce charts, projections, balance sheets and inheritance tax ledgers. We can put in key events such as weddings and the sale of a business. We can even kill you off next year, just to see what happens. We can tweak every assumption that lies behind the model to make it as realistic to your circumstances, and the wider economy, as is possible.

The level of detail is quite astonishing. Every change from HMRC on future tax rates are factored into models automatically, within days of announcement.

This week we made a big difference to a couple’s life, confirming that which they suspected: they don’t actually need to work anymore. They have accumulated more than enough to last comfortably until their assumed mortality age (itself selected by the client on the grounds of family history and the Office of National Statistics).

In the past we have helped clients assess their inheritance tax liability, choose between different redundancy options, set the amount of savings contributions required to pay for their children’s education and more.

In the past we have helped clients assess their inheritance tax liability, choose between different redundancy options, set the amount of savings contributions required to pay for their children’s education and more.

As stated above, every model has its limitations, but it is worth coming to see us to gain some understanding of how your future looks rather than earning and spending money in the dark. And as we see confirmed every day when small tweaks are made to client’s plans, a change today can make life quite different in 20 years.

Malcolm Stewart